The copyright landscape is evolving at an unprecedented pace, and corporate adoption is playing a pivotal role. Lately, the spotlight is focused on Bitcoin as a tactical asset for corporate treasuries.

Organizations are increasingly seeing the benefits of incorporating Bitcoin into their treasury strategies. This movement demonstrates a growing acceptance in Bitcoin's security.

- A number of firms have recently announced their strategies to invest Bitcoin on their treasury reserves.

- Such actions suggest a major shift in the established treasury paradigm.

- This integration of Bitcoin by corporations contributes the acceptance of cryptocurrencies as a trusted asset class.

Major Players Entering the Bitcoin Market

Bitcoin has witnessed/is experiencing/continues to see a surge in/of/with institutional investment/interest/adoption. This trend is driven/fueled/motivated by several factors, including/such as/among which are the increasing acceptance/legitimacy/recognition of cryptocurrencies, potential for/promise of/anticipated high returns/profitability/yields, and the desire/need/opportunity to read more diversify/hedge against/protect against traditional asset portfolios. Major financial institutions/investment firms/corporations are now actively participating/increasingly investing/making significant allocations in Bitcoin, signaling/demonstrating/highlighting its growing status/credibility/mainstream appeal.

- Some/Notable/Several examples include/comprise/feature hedge funds like Grayscale Investments/Pantera Capital/SkyBridge Capital, asset managers/wealth management firms/investment banks such as BlackRock/Goldman Sachs/Fidelity Investments, and even public companies/corporations/major enterprises like Tesla/MicroStrategy/Square.

- This institutional flow/movement/interest is expected to/projected to/anticipated to further fuel/boost/accelerate the growth of the Bitcoin market, potentially driving/lifting/pushing prices higher and increasing/broadening/expanding its global adoption/acceptance/use.

copyright Treasuries: The New Frontier for Corporate Balance Sheets

Corporations are increasingly exploring the promise of copyright treasuries. These digital asset holdings offer a unique way to augment balance sheets, providing protection against traditional market volatility and leveraging new financial avenues. As the copyright landscape develops, we are witnessing a trend towards institutional adoption, with companies of all sizes implementing blockchain assets into their financial structures.

- Additionally, the transparent nature of cryptocurrencies resonates with companies seeking enhanced control over their assets and a reduction in reliance on conventional financial institutions.

- Nevertheless, there are challenges to navigate, including regulatory uncertainty and the need for robust governance frameworks.

As the copyright treasury space continues further, it will be important for corporations to implement a holistic approach that balances both the potential rewards and risks.

Unlocking Value with Bitcoin: Institutional copyright Holdings

The digital asset market has witnessed significant growth in recent years, attracting the focus of institutional investors worldwide. Corporate holdings of Bitcoin have surged, signaling a growing belief in its potential. This trend presents both challenges and advantages for the broader copyright ecosystem.

- Institutional investors are increasingly investing their portfolios to include Bitcoin as a safe haven.

- Legal clarity is crucial for institutional adoption and market growth.

- Bitcoin's decentralized nature appeals with institutions seeking transparency financial systems.

Bitcoin's Rise as an Alternative Asset Class: The Corporate Perspective

Corporations globally/across industries/worldwide are increasingly/gradually/rapidly exploring Bitcoin as a viable/potential/promising alternative asset class. This shift/trend/movement is driven by several factors, including/such as/consisting of its potential for hedging/diversification/protection against inflation/economic uncertainty/market volatility. Moreover/Additionally/Furthermore, Bitcoin's decentralized/transparent/secure nature appeals to/attracts/resonates with corporations seeking/desiring/aiming for greater control/alternative investment options/financial independence.

Some corporations have already/are currently/began integrating/allocating/involving Bitcoin into their balance sheets/investment portfolios/treasury management strategies. This demonstrates/highlights/underscores the growing acceptance/recognition/adoption of Bitcoin as a legitimate/serious/valuable asset class within the corporate world. Ultimately/However/Nevertheless, the long-term impact of Bitcoin on corporate finance/investment strategies/asset allocation remains to be seen.

From Wall Street to Main Street: Corporations Integrate Bitcoin

Bitcoin, once a fringe currency embraced by tech enthusiasts and visionaries, is rapidly making its way into the mainstream. Corporations, from tech behemoths to smaller firms, are starting with Bitcoin in a variety of ways, signaling a potential paradigm shift in the financial landscape.

Some corporations are incorporating Bitcoin as payment for goods and services, while others are investing their reserves into the copyright. This shift reflects a growing confidence in Bitcoin's long-term potential as a alternative asset.

The reasons behind this corporate embrace are multifaceted. Some companies aim to leverage the transparency of Bitcoin, while others look for new revenue streams.

Regardless, this trend has significant implications for both the financial world and society as a whole. It raises questions about the future of money and highlights the revolutionary nature of blockchain technology.

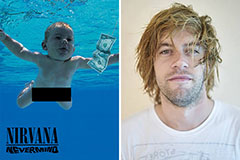

Spencer Elden Then & Now!

Spencer Elden Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Marla Sokoloff Then & Now!

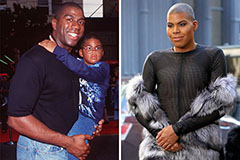

Marla Sokoloff Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!